FinancesUpdated Mar 21, 2023

Investing in your 20s: Your Top 5 Questions Answered

Are you thinking about stock market investing for the first time? Our guide takes you through the top 5 things you need to know about stock investing through a Stocks and Shares ISA, including how it works and how much risk to take.

1. What is “investing”, and why should I invest?

By the time you have finished this guide, you will have lost money. No, not because of a scam or a dodgy competition, but because of that complicated word “inflation”.

Inflation refers to the rate at which the prices of things go up. It’s usually about 3%, which means that if you had £100 to spend this year, it would cost you £103 to buy the same stuff next year. But at 10% today, the price of things is increasing far faster than our wages.

For every £10.00 in our account now, at least £1.00 has been shrunk out of it, leaving us, through our day-to-day shopping, over 10% poorer.

But you probably already noticed that; the 10p extra on top of your sausage roll or the more expensive pair of jeans. For every purchase you make, the more money you lose, and no matter what bank you choose, your savings aren’t increasing in the way they used to — and I’m afraid that if you leave your money in your bank account, there isn’t much you can do about that. Interest rates (the percentage of money a bank will give you on top of your savings if you choose to bank with them) are below inflation. At their best, their absolute best, they give you 3-4% of additional money each year on top of your savings. This is at least 6% less than inflation! And in any case, their rates aren’t exactly life-changing.

Let’s say you put £4,000 into a savings account with an interest rate of 0.5%. In one year, the bank will give you just £20 (0.5% of £4,000). Even if you had £40,000 of savings, the bank would only give you £200 (0.5% of £40,000), which, to quote Boris Johnson, “is chicken feed”.

But what if there were something you could do that would help you keep up with inflation or even beat it? Something that would mean, in the long run, you would have more money to spend, not less?

There is. It’s called stock investing.

Investing means putting money in the “stock market”

The stock market is a bit like a supermarket where you can buy or sell tiny percentages of companies like Tesla and Amazon instead of food. When you buy stocks in a company, you become a part-owner, and your shares’ value will increase and decrease with the company’s valuation.

Why do companies' share prices rise and fall?

Most people will tell you that “how much money the company is making” determines its share price. However, the most important thing to understand is that, actually, the share price is determined by feelings.

People buy stocks when they feel like a company is a good investment. If later, they feel like that company is now a bad investment, they sell their shares. These feelings are indeed influenced by factors like how much money the company is making, but they are also strongly influenced by things outside the office's walls, like news revelations, social media posts, or even just rumours.

Take Tesla’s share price, for example. In May 2020, Elon Musk went on an unusually lengthy Twitter rant in which he expressed that Telsa’s share price was too expensive and that he was selling practically all of his possessions and would never buy a home again. As a result, there was an immediate 10% drop in share price despite it having nothing to do with how many cars Tesla was selling.

Closer to home, in July of the same year, Boohoo found itself at the centre of a media frenzy when newspapers reported that employees in Leicester's textile mills were working in unsafe conditions, without pandemic protection, and getting paid as little as £3.50 an hour. This plummeted the share price despite record sales of £976m just a few months earlier. Shares today are 86% lower than they were before the revelations.

In both examples, the crucial thing to understand is that the change in share price was determined by investors’ feelings towards the company rather than the company’s sales or performance. When they read the tweet or news report, they felt concerned about keeping their shares in the company, so they sold them. As a result, there was more supply of shares which decreased the value of all the shares. And when the collective share price started to decrease, more people became scared, so more people sold, reducing the share price even further!

In the case of Tesla, after the drop, investors realised that there was no material change in the company structure or ability to trade, so share prices quickly went back up (more below). Regardless though, it shows the power of investor feelings (sentiment) in overall share price changes.

Of course, other reasons, like changes in the overall political or economic landscape, also play a part in share price changes. But in either case, understanding the fundamentals of a share price’s increase or decrease goes a long way to making a good investment — and don’t worry, we’ll talk about this more.

How do you start investing in the stock market?

Movies like the Wolf of Wall Street make this “investing” seem more exciting, more elite, and perhaps grosser than it actually is. Yes, there are still men in suits who negotiate over the phone, but today's reality is that simple apps mean that “investing in the stock market” is no longer a privileged, inaccessible or daunting activity.

Today, you can download easy-to-use trading platforms like Hargreaves Lansdown, or Revolut, to make investments straight from your phone (more below). All you need to decide is which account type to use and which funds or companies to invest in…

What is an ISA in the UK?

An ISA (Individual Savings Account) is a bank account where you may save money tax-free. This is better than other investment accounts where you must pay tax on any earnings. This might sound like a small detail, but at 20%, this tax is a big deal.

The caveats are that you must be over 18 years old (except for cash ISA, which is 16+), and you can only invest up to £20,000 per year. But for you and me, that is more than enough.

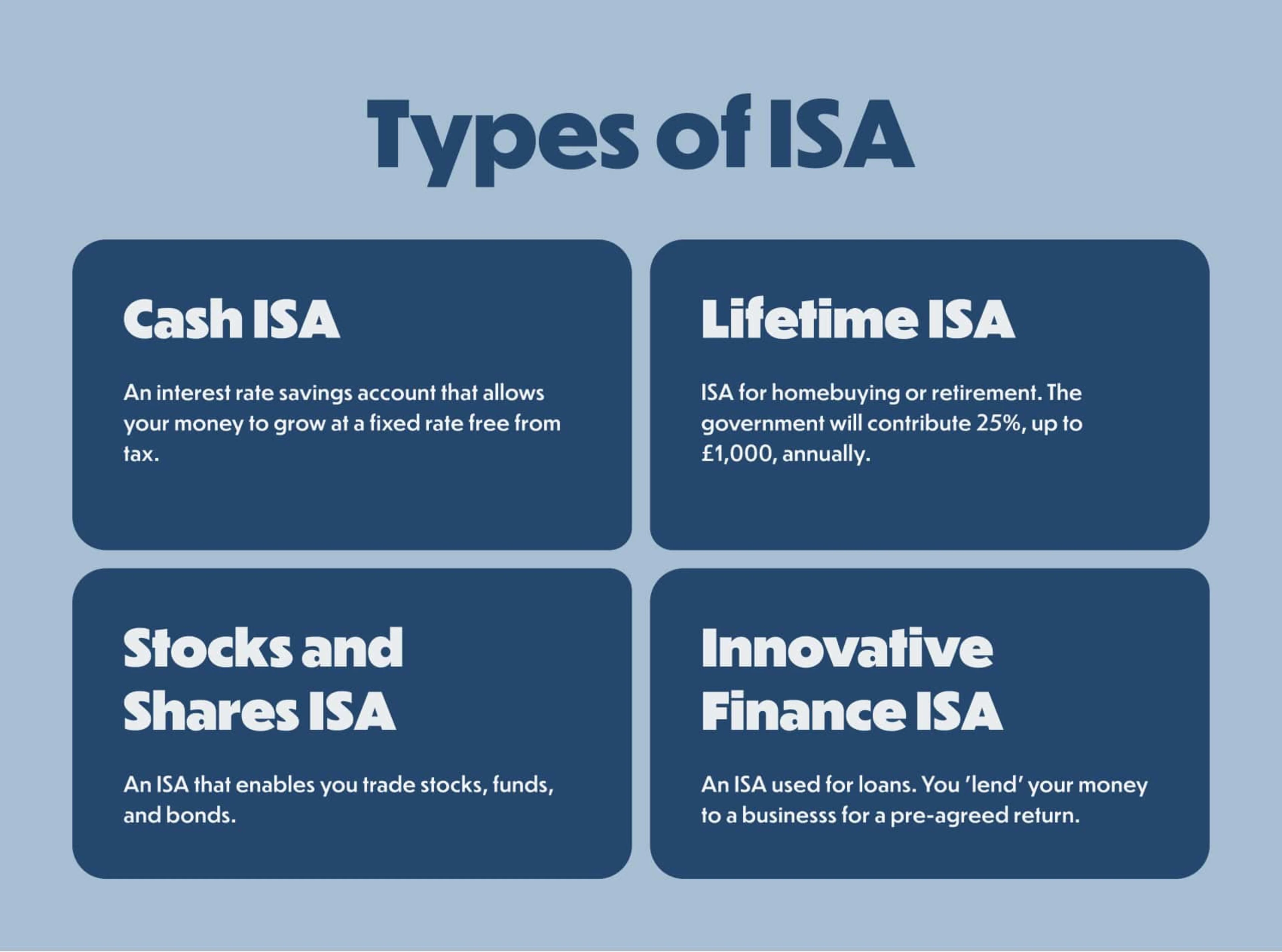

How many ISAs are there?

There are 4 different types of ISA. The government lets you open one new ISA each year, so over 4 years, you could, if you wanted to, open one ISA of each type. But best to start with one:

- Cash ISA - to make money through bank-provided interest rates.

- Lifetime ISA - to buy your first home or save for later life.

- Innovative Finance ISA - to make money by loaning to companies.

- Stocks and Shares ISA - to make money by investing in the stock market.

All are tax-free, including income tax and capital gains tax.

Most people you talk to will recommend a Cash ISA to put your cash savings. It all depends on your investment goals, but to us, Cash ISAs are nearly identical to bank accounts so we don't see the point. Instead, open a Stocks and Shares ISA. Directly investing in the stock market can be more profitable. You’ll also learn how it all works which will prep you for later life and future success.

Let’s start your investment journey!

2. What is a Stocks and Shares ISA?

A Stocks and Shares ISA (Stocks and Shares Individual Savings Account) is basically the same as a normal bank account but with one key difference; the money you put into your investment account can be used to invest in the stock market, which, as I mentioned above, is a bit like a supermarket where you can buy or sell individual stocks of companies like Meta, instead of food.

The aim is that over time, as the companies you have invested in do well, your money invested will increase, meaning you make a profit. And as the years go by, your account will grow and grow, giving you more money that you can cash out at any time.

How is it different from a bank account?

Banks invest in stock markets too. The only difference is that when the banks do it, they get to keep all the money, and we get... a paltry amount of interest.

I mean, let’s not forget that a bank exists to raise money. Each bank is essentially a big investor that uses clever slogans like “By your side” to disguise itself as a nice friend that keeps your money safe. But bankers’ Aston Martins don’t pay for themselves, you know! We pay for them!

When we put money in a bank account, we give bankers permission to use it for stock market investing in companies and opportunities that will grow the most money.

Just imagine a gigantic pot made up of everyone’s savings, all invested in the UK stock market. At 10% profit, that’s billions of our pounds generating millions of extra pounds out of thin air! In a fair world, the bankers would dish this out. But, instead, they pocket most of this and drop the crumbs onto us mere mortals. The average savings account right now pays a measly 0.5% interest. They’re quids in! And all they did was what you could have done yourself. Invest.

What are the benefits?

Over a bank account, an investing account has three major benefits:

- You stay ahead of inflation. Even though it varies greatly, inflation typically runs at a pace of 3-4% every year. As of 2022, it is running above 10% and bank interest rates are sitting at about 2% still, meaning you are losing money each year. By investing your money you could make 7% on top of your savings, for example, meaning you won’t be losing money.

- You can build upon your savings tax-free. With the best investments, you could earn up to 20% more money. That £40,000 we talked about earlier. 20% you net you an additional £8000 per year as opposed to the measly £200 at 0.5% interest. As opposed to other types of accounts, Stocks and Shares ISAs are also tax-free, meaning any money you do make is all yours.

- You learn about the stock market. This sounds less appealing than it actually is but learning how these things work goes a long way in life, and the best way to learn is to do it. So do it.

If you're thinking that these are all copy-pasted from a bank advertisement, here's the kicker - money deposited in the stock market is not guaranteed by the government like it is for money in cash accounts, so the profit is completely up to you, and the risk is completely in your control. Speaking of…

I’ve heard it’s risky… how risky?

Our parents, who say investing is a risk, clearly don’t have a pension or individual retirement account. Oh…they do have a pension? In which case, they are hypocrites.

You see, a pension is an investment provider into which we add money during our employment to invest for our retirement. The money that goes into a pension is used by bankers to invest in the stock market to make money for themselves. When we turn 65 we can take a slice of the money made, but a chunk of it still goes to investment bankers.

Sound familiar? That’s because it is essentially the same as a bank account. You put money in; they invest it into an investment portfolio for you. Yes, there is a difference. These bankers are knowledgeable and trained in what to invest in. But let’s remember here, the control is utterly in your hands.

Depending on how much risk you want, you can use different strategies (see below). If you feel like being risky, you can invest money in some more high-risk-high-reward companies. If you want to have less risk, you can invest in a trust fund (see what is a fund?) in which case someone else will be making the investment decisions on your behalf, slashing your risk significantly. It is all up to you. and provided you follow the 5 golden rules of investing, you are unlikely to find yourself in any deep water.

The 5 golden rules of investing:

-

Only invest what you can afford to lose. It is a common misconception that you need to be extremely wealthy to start investing in the stock market. You don't, and other investors who "drip-feed" little amounts on a regular basis can outperform those who dump a huge bulk sum. However, you should only invest what you can afford to lose or not have. Take an honest look at your finances. If you think you might need the money in a few weeks or months, don’t invest it. And if the stock market crashes, you might lose a lot of money if you have a large amount of money invested. You can weather any loss-causing market shocks by investing over a long period and diversifying your investments (points 2 and 3), but sometimes even that won’t save some of your money from falling, in which case, you must decide on your risk tolerance, own investment decisions and make peace at the possibility of losing a vast majority of money.

-

Save and invest for at least 5 years. Investing is not a “get rich quick scheme”. Once you have bought shares, you should keep them even if they decrease in value. That’s because, although over the short term shares can fluctuate dramatically, over the long run, however, stocks and shares tend to increase and have historically outperformed money in savings accounts.

-

Choose companies that are different from one another. Having a diversified investment portfolio is one of the most important pieces of investment advice as it allows you to weather market fluctuations. Different industries aren’t necessarily exposed to the same problems. Aviation, for example, suffered terribly during the Covid-19 pandemic and many shares still haven’t recovered. If you had invested all of your money in airlines you would have lost most of it. To prevent this, don't put all your eggs in the same basket; invest in multiple asset classes, firms, industries, and geographies (known as “diversifying”) so that if there are downturns in one market, it won’t affect all of your money.

-

Don't panic. Investments go up and down. Don't give in to the temptation to purchase or sell individual stocks just because everyone else is. You should always assess the fundamentals of a company (point 5) to make sure you are making decisions based on information and data, rather than emotion.

-

Assess the fundamentals. Ignore loose predictions and what other people are doing. A company is made up of people, assets, products/technology and customers. When evaluating whether to buy or sell shares, you should assess whether these four factors have changed. In the face of share price volatility, up or down, do some research to check if these fundamental areas have been affected by something and ask questions like:

- Has the value a product gives to a customer changed?

- Has the team gotten worse?

- Has something happened that affects the company’s ability to trade?

If the answer to questions like these is “no”, then the doom-mongering or raiding is likely just a baseless hype train. Remember dogecoin? Everyone started buying it in 2021 because everyone else was buying it. If you did join the hype train at its peak you would have lost a lot of money. If you instead, researched the company and assessed the fundamentals, you would have not invested:

- People: Billy Markus and Jackson Palmer, who decided to create a payment system as a "joke".

- Assets: None.

- Product/technology: Dogecoin is an open-source paint job of Bitcoin. It does not have its own blockchain technology and has no value proposition as all the technology is in Bitcoin, which has had many other paint jobs.

- Customers: None.

3. How do I start investing with Stocks and Shares ISA?

It might sound daunting, but investing in the stock market is actually really easy today. There are loads of fantastic investment platforms that operate right on your phone and you can start with as little as £1 - the amount you need to open an ISA account. All you need to do is:

- Choose an investment ISA provider (investment platform).

- Select what to invest in it.

What investment platform (ISA app) should I use?

Like buying food from a shop, you must first choose which shop to buy the food from (which app to utilise), then which food to buy (your shares in companies or funds). We have made a list of our top 5 investment apps which you can take a look at:

On the other hand, if you are interested in shopping around, there are 4 considerations when deciding on an investment account:

- How trustworthy is it? New platforms spring up all the time. Some are a bit dodgy. Only use platforms that are long-established and have many users.

- How easy is it to use? You want to be thinking about what to buy, not scratching your head wondering how to buy or sell stocks. Some platforms offer features like "interactive investor' to help you match your investment goals with particular individual stocks so you can make the best investment decisions. On the other hand, other investment platforms offer a ready-made investment portfolio so you can start investing without tonnes of research.

- How restrictive is it? Some apps only allow you to buy funds, or from companies in specific countries. Make sure you choose an app that gives you the freedom to buy and sell what you want.

- What fees do they charge? When you use an app, you have to pay a small percentage to buy shares. Both the app AND the shares/funds you invest in will have fees, similar to how each supermarket might charge a different price for shopping bags. For serious investors, this is a big deal, but for you and me, this doesn’t matter most of the time. In any case, the fees to look out for are:

- App charge — This will probably be a percentage of the share you bought (bigger investments cost more). In some cases, it will be a flat charge (ideal for high investors).

- Selling/buying funds and shares — This is the fee when buying or selling shares/funds on the app and ranges from £0 to £25. This won't matter if you don’t buy much and just stick with your shares for a long time.

- Annual management charge (Fund manager fee) — You'll also be charged for the cash you invest. This is the manager's fee for your Stocks and Shares ISA. Is a percentage of the amount you keep in the fund and can range from 0.05% to 1% + per fund.

What do I need to set up a Stocks and Shares ISA?

If you’re a UK resident and aged 18 or over, you can set up a Stocks and Shares ISA. To set it up, you’ll need:

- A UK bank account

- Your national insurance (NI) number

- Your passport or driving license.

Once you have this you can start trading with £1. In the same tax year, you can then put up to £20,000 into an ISA and the government will take no tax off any money you make.

Creating an account on one of the apps mentioned above will kick-start the process.

How do I buy stocks with a Stocks and Shares ISA?

Buying shares is like buying anything else. You find what you want to buy, check the price, and pay for it. But with shares, you also need to consider whether the price may go up or down and how that might affect your investment.

The steps to buying shares are:

- Add Money — You need to add money to your account first. You can add money by paying into your Stocks and Shares ISA from your current savings account. When money is transferred into your ISA, it is held as cash until you decide to buy shares with it.

- Search — Search companies, index funds, mutual funds or exchange-traded funds you want to invest in. It all depends on your investment goals. If you already know what you want to invest in you can search and find it using the app. If you’re less sure, many apps have a list of their top shares or exchange-traded funds which you might find useful (more below).

- Decide — You can also use the app to find information about a company or fund, including the price of the shares and how the company is doing. Some apps even have reports about each company or fund. You can use these to decide whether or not to invest. If you want to go deeper, try googling the company to understand it better.

- Invest — Once you are set that you want to invest in a company or fund, it will be as simple as pressing “Buy” and then deciding the amount of money, or number of shares, you want to spend or buy. With most platforms, companies or funds, you will need to spend at least £100. Once they are bought you will have to wait at least 24 hours for the shares to appear in your account.

- Track — Once the shares are in your account, you can track their performance through the app.

What is the difference between income and accumulation shares?

There are 2 types of shares: Income shares and Accumulation shares. Each pays differently and is best for different types of investors.

Income Shares

Income shares pay "dividends" to their shareholders.

“Dividends" are part of the company’s profits they pay out to their shareholders.

This means that if the company is doing really well in one year, you will receive a lot of money as thanks for investing. These dividends are usually paid 2 or 4 times a year, and each time, you will receive cash directly into your account to do with what you wish.

However, if the company is doing badly, it doesn’t have to pay dividends, and in some cases, it won’t.

Accumulation Shares

Accumulation shares don’t usually pay dividends but instead reinvest the profits into the company to help it grow.

The result is a greater rate of growth but less income from it which pays in the longer term.

You will need to decide if you want shares with dividends or not. This depends on what you want from your money.

If you want regular income - Income shares.

If you want more growth - Accumulation shares.

What is an ISA allowance?

There are 2 types of restrictions to be aware of when investing with a Stocks and Shares ISA:

- The first is the £20,000 per year investment limit. Each year you are only able to invest £20,000 across all of your ISAs. So if you have a Stocks and Shares ISA and a Lifetime ISA, for example, your £20,000 allowance is spread between the two. The annual ISA allowance resets each tax year, which is usually at the start of April.

- The second set of restrictions is from the provider you have chosen. For example, some apps let you buy only from companies listed on the London stock exchange, while others may restrict you to only buy shares of a certain size, or only allow you to buy funds and not shares. You should check what the restrictions are before you decide on an ISA provider.

How do I sell shares with a Stocks and Shares ISA?

You can sell your shares when you are in profit and feel like cashing in, or wanting to cut your losses. To sell, simply open your shares and press “sell”. In around 24 hours your money should be deposited back into your account as cash. Remember, you should hold onto your shares for at least 5 years before you sell.

4. What stocks should I buy?

It isn’t always easy to know what individual stocks to buy. So to start with, it might be a good idea to buy into companies that you already know — companies like Amazon, Apple, and Google — which have a history of doing well.

But in either case, it always pays to diversify as much as possible. This means buying individual stocks in different companies, industries and countries.

The main reason this is important is that it helps protect you if one of the investments you have made starts doing badly. Because the other investments you have made are going well, you don’t lose as much money. And that’s where funds come into it…

What is a fund?

A fund (mutual fund, index fund or exchange-traded fund) is like a big basket full of different investments, like shares in companies and government bonds. And because funds are made up of lots of different investments, you are spreading the risk.

For example, you could buy into a fund made up of companies listed on the London stock exchange. That would be safer than investing in a single company, because if one of the companies in the fund did badly, you would still make money from all the other companies in the fund.

Every mutual fund or index fund has a theme, such as a geographic focus (Europe, Japan, developing countries), an industry focus (green, utilities, industrial), a form of investment focus (shares, corporate bonds, gilts), or a business focus (large, medium, or small). Your investment decision will depend on your personal circumstances and how much risk you can take.

For example, let's say the fund focuses on "developing tech businesses in emerging markets". It will involve a significant level of unpredictability. Therefore, if it succeeds, you may reap huge rewards; yet, if it fails, you could suffer enormous losses. It depends on your risk tolerance.

An alternative is a FTSE 100 tracker, which is far more common and just invests in the 100 largest firms in the UK. This is an example of “passive fund management" when a stock portfolio buys the same assets in the same proportions (e.g. the fund is made up of 10 different companies at 10% each), and then holds them over time. This type of fund carries little risk so it is a popular investment.

If you want to take a little more risk, you can choose one of the actively managed funds. You see, some funds have active fund management when a fund manager makes decisions about what individual stocks to buy and sell in a fund depending on the financial goals of the investors. It's a bit like having your own financial adviser. In these cases, you should look up who the manager is and assess their credentials and previous financial success. The money you can make in managed stock mutual funds is generally higher, but the fees are slightly higher too.

Which company or fund should I start investing with?

As before, there isn't necessarily one answer to this question. It depends on what you are looking for in an investment and your risk tolerance. As we discussed, as a general rule, it is best to start with companies or mutual funds that you are familiar with. That way, you have some understanding of how they operate and what might make their share price go up or down.

Hargreaves Lansdown has a list of popular stock mutual funds. I would recommend starting with one of these! If you click on one of the stock mutual funds, you can read the research surrounding the fund, check its past performance, and see what company shares make up the mutual fund, influencing your decision to invest in it.

How much should I invest?

While there is no right or wrong answer when it comes to deciding how much to invest, as a general rule, you should always invest as much as you can afford. Investing a large sum of money will mean you are more likely to make bigger profits, but it also means you face greater risks.

For a first investment, you should probably buy the minimum number of shares you can to learn the ropes. Every company or fund has a minimum amount that you are required to invest. For example, Vanguard has a minimum investment of £500 for stocks and shares, whereas Hargreaves Lansdown has a minimum investment of £100. Start with these and see how you get on!

It might be worth simply buying the minimum amount each time and using the money saved to invest in more index funds as part of a diversified portfolio.

How can I stay up to date with which stocks to buy?

To ensure you are keeping up with what individual stocks to buy with your Stocks and Shares ISA, follow these tips:

Create a portfolio of companies or mutual funds, and update it regularly. This should contain the companies or mutual funds you have invested in, how much you have invested, and why you have invested in them.

Research the companies and funds you are interested in regularly. There are many ways you can do this: from checking their latest financial reports to listening to a podcast of a financial advisor.

5. When should I buy and sell stocks?

Now that you know the kinds of companies and funds to buy, we need to consider when you should buy and sell.

Buy when low, sell when high.

There is a strange phenomenon in investing where most investors seem to buy shares when there is a buzz about a company, driving up the share price far above average. In the same way, these same people seem to sell their shares when the value of their investment goes down, which means they lose money. This is the opposite of a wise investment strategy.

Your aim is to buy when the share price is low and sell when the share price is high…

Don’t believe the hype.

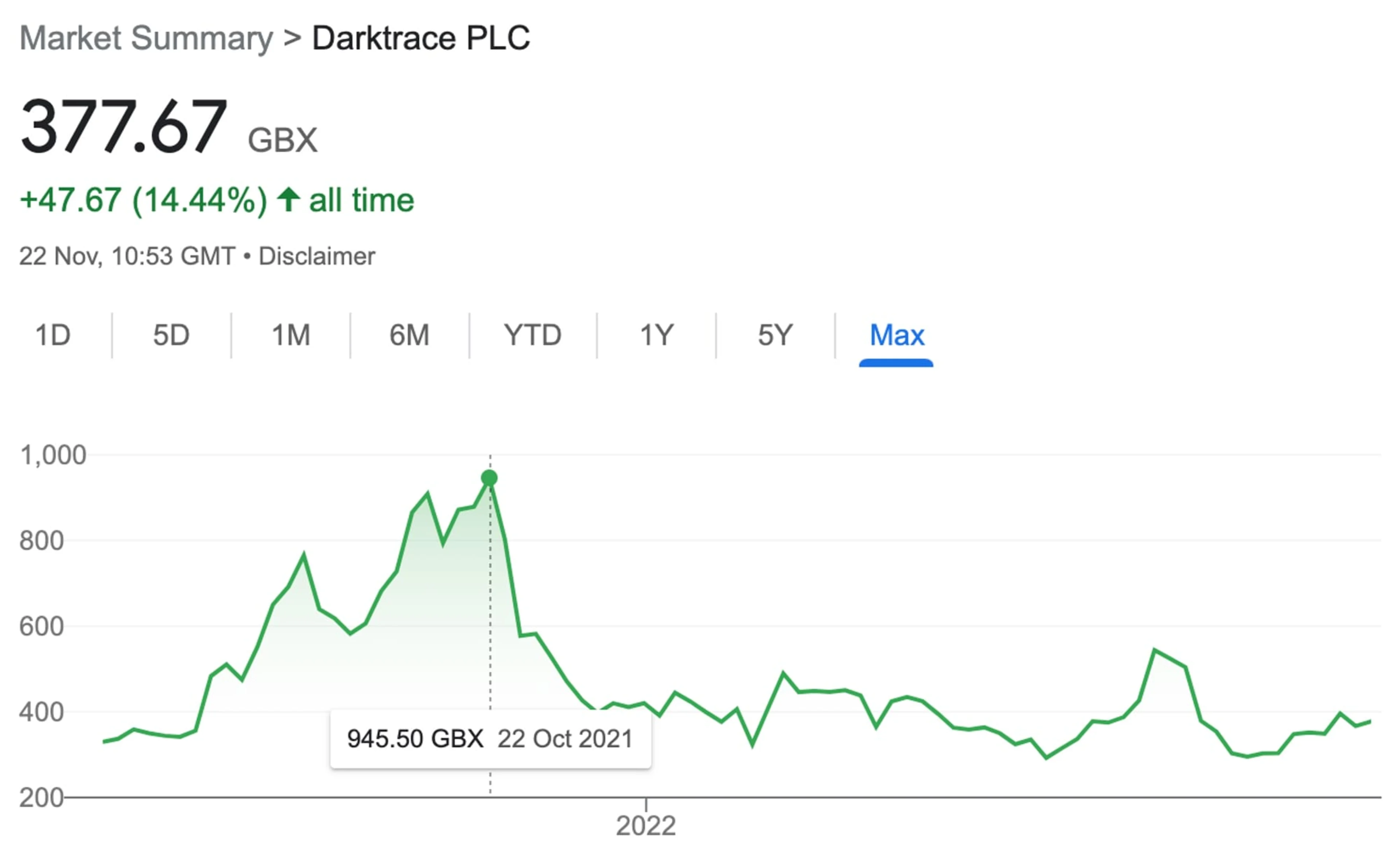

If you hear about an awesome investment idea from a friend or the news, the boat has probably already sailed. At this point, the share price will already be high, and you could set yourself up for some losses because the share price may decrease once the hype goes. This was the case with Darktrace:

When others flee, pursue.

When the share price of a company or fund dramatically falls, it might be a good idea to buy because if/when they increase back to their average price, you will have made an easy profit.

Of course, take this with a small dose of caution and a heavy dose of research. It might be the case that the share prices have dropped for good reason; let’s not forget the 5 golden rules of investing. As long as the company or index fund checks out, and its fundamentals are unchanged, the price drop might just be a temporary shock, indicating a good bargain.

You can track the share price and market index of companies or index funds using your chosen app or online share portfolios and look out for dips and peaks to assess a good time to buy. You could even compare the share price to the company’s earnings per share. This will give you an estimation of the share price's value. A high price means the share is overvalued, and a low price means the share is undervalued. This could help you decide when to buy.

You don’t need to think about selling.

You don’t need to think about selling at this point — it is way down the line. Remember that you should keep hold of your investments for at least 5 years. In fact, the longer your hold onto them, the better. You should only sell shares for a profit if you need the money or to minimise losses if there's no hope of recovery.

Hold on a year longer.

Timing the market is difficult. You may have heard the phrase time in the market is more important than timing the market. This means that rather than trying to time the market (i.e. deciding when the best time is to buy an investment and when the best time is to sell it), it is better to simply buy an investment and hold on to it for many years. Remember that long-term performance is better than short-term, so the more you wait, the more money you are likely to make.

Ride out the ups and downs with pound-cost averaging.

If you are really unsure of when to buy, you can avoid the worry of wondering whether a stock is about to move higher or lower by committing to a set buying schedule.

This is called pound-cost (or dollar-cost) averaging.

Pound-cost averaging is when you invest the same amount of money into a share or shares at a fixed rate at intervals (say every month). This is beneficial because it smooths out the highs and lows of share prices over time.

Let’s say you wanted to buy some shares and you are not sure if you are buying them at a good cost. Maybe they are too expensive and you are about to lose money?

You can avoid this.

Instead of purchasing the shares all at once when you may be buying at an all-time high that won't be surpassed for months or years, you can buy smaller amounts every week or month.

This will mean that, over the months, the average cost you paid for the shares will be in the middle of the highs and lows, so you will avoid being stung if the share price drops.

It is all a bit confusing and out of scope for this article so here is a great video that explains it all:

Check-in regularly and keep up to date.

You should not need to update your portfolio regularly. But you should still keep an eye on the companies and index funds you have invested in and stay up to date on your research!

It only takes 10 minutes a week to track your investments and ensure you are following the 5 rules of investing!

Next steps

In this guide

Write at The Fledger

Have a guide in mind?

The Fledger is open to voices from all backgrounds. Get in touch about your idea and give your words flight.

Shoot us a message